Simple Interest vs Compound Interest Key Differences

Simple Interest vs Compound Interest: The Complete Guide

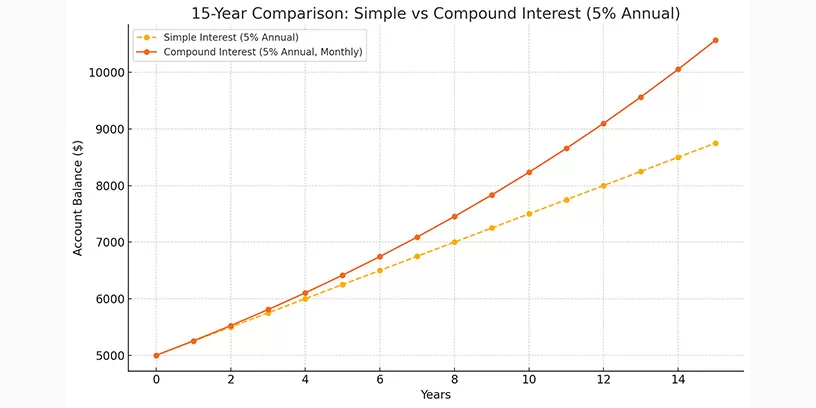

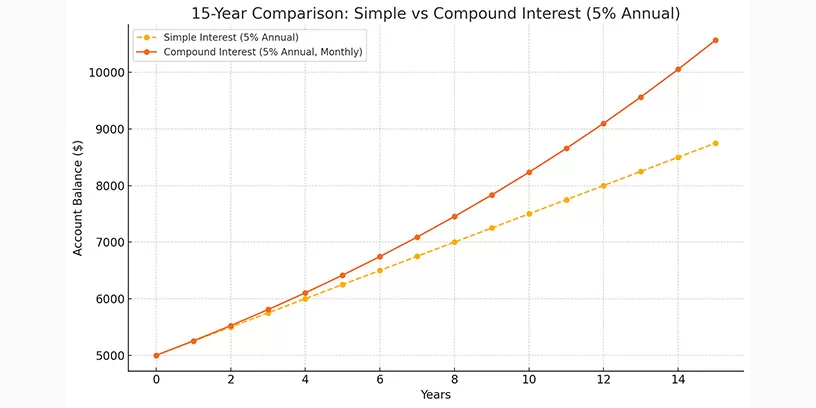

When it comes to loans, savings, or investments, one of the most important things to understand is how interest is calculated. The terms simple interest and compound interest appear everywhere from bank accounts to credit cards yet many people don’t know how much of a difference they can make to their money.

Whether you are taking out a personal loan, investing in a savings account, or planning for retirement, the type of interest applied can significantly impact your total cost or returns. In this detailed guide, we will explore what simple interest and compound interest mean, how they are calculated, their pros and cons, and when to choose which. To make things easier, you can instantly run your own numbers using our free Simple Interest Calculator and Compound Interest Calculator right on this page.

What Is Simple Interest?

Simple interest is the most basic way of calculating interest. It is applied only to the original amount you borrowed or invested (called the principal) and does not take into account any interest that has been previously earned or paid.

Formula for Simple Interest:

SI = (P × R × T) / 100

Where:

- P = Principal (initial amount)

- R = Interest rate (annual)

- T = Time (in years)

Example:

If you invest $5,000 at 8% simple interest for 3 years:

SI = (5000 × 8 × 3) / 100 = $1,200

At the end of 3 years, your total amount will be $6,200.

Key Benefits of Simple Interest:

- Predictable: The interest amount stays the same every year.

- Easy to calculate: Perfect for quick mental math or short-term loans.

- Better for borrowers: You generally end up paying less than you would with compound interest.

What Is Compound Interest?

More powerful because it adds previously earned interest back to the principal, allowing you to earn “interest on interest.” This process causes your money to grow faster and is the foundation of long-term wealth building.

Formula:

A = P (1 + r/n)^(n × t)

Where:

- A = Final amount

- P = Principal

- r = Annual interest rate (in decimal form)

- n = Number of compounding periods per year

- t = Time in years

Example:

If you invest $5,000 at 8% interest compounded annually for 3 years:

A = 5000 (1 + 0.08/1)^(1×3) = $6,298.56

That’s nearly $100 more than with simple interest and the difference grows larger with time.

Key Benefits of Compound Interest:

- Faster growth: Ideal for long-term investments and retirement planning.

- Flexible: Can be compounded yearly, quarterly, monthly, or even daily.

- Works in your favor: The earlier you start, the bigger your wealth grows over time.

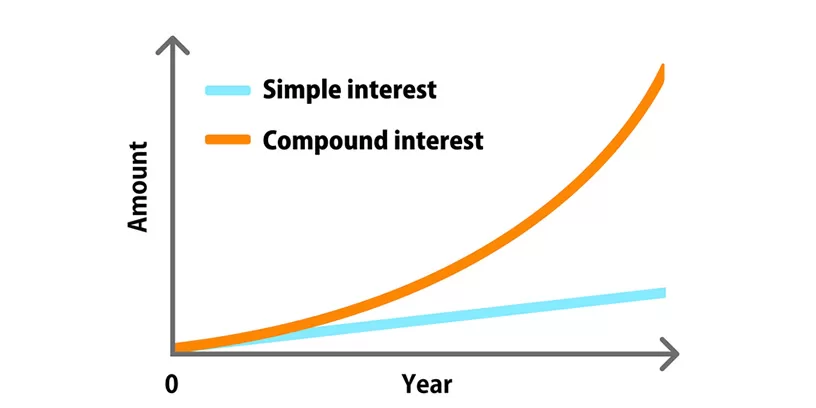

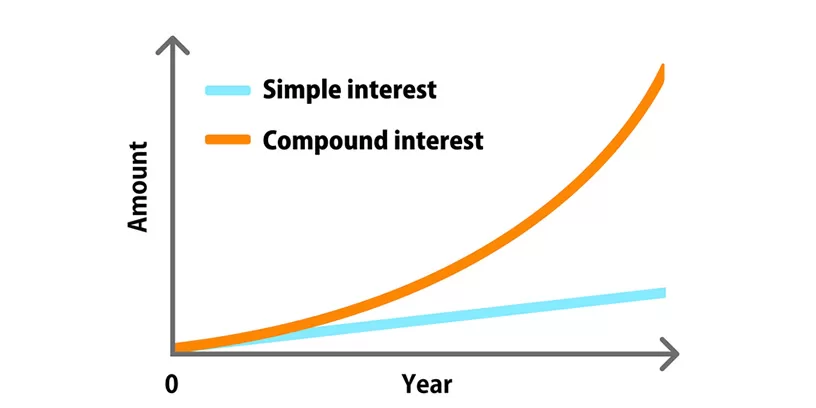

Comparison

| Feature | Simple Interest | Compound Interest |

|---|---|---|

| Calculation | Only on principal | Principal + accumulated interest |

| Growth Pattern | Linear | Exponential |

| Best For | Short-term loans | Long-term savings & investments |

| Cost for Borrower | Lower | Higher (if compounding is frequent) |

| Benefit for Investor | Limited | Maximum returns over time |

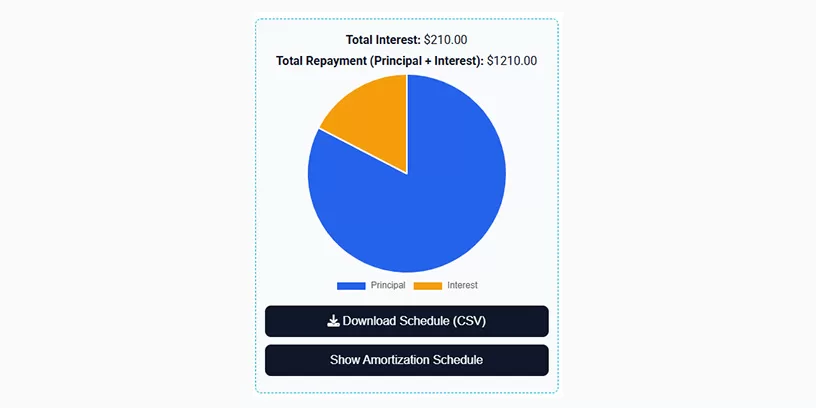

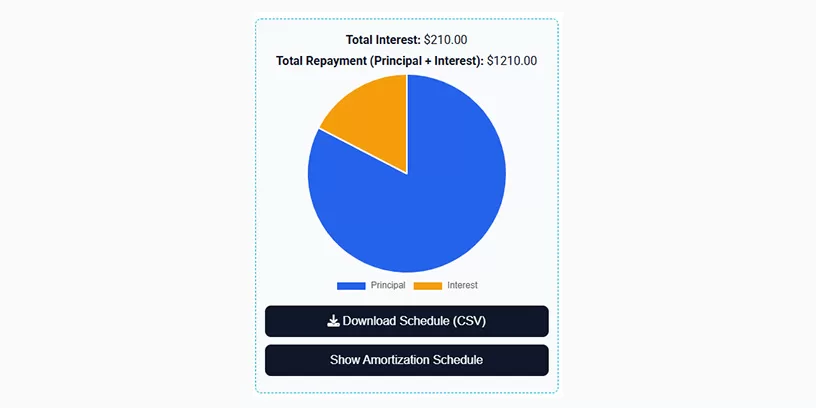

Calculate Instantly with Free Tools

We’ve made it easy for you to compare interest types and understand their real impact.

Simple Interest Calculator

Try the Simple Interest Calculator – Instantly estimate interest payable and total amount.

Compound Interest Calculator

Use the Compound Calculator – See how compounding can grow your savings faster.

These calculators are perfect for students, professionals, investors, and business owners to make smarter financial decisions.

When to Use Each

Choose Simple Interest:

- Short-term loans like car finance or trade credit

- Situations where you want predictable, low-cost interest

Choose Compound Interest:

- Long-term savings goals like retirement planning

- Investment accounts where growth compounds over years

Rule of Thumb: Borrow with simple interest, invest.

Final Thoughts

Understanding is one of the most important financial lessons. Simple interest is straightforward and predictable, while compound offers exponential growth that can work in your favor as an investor. Start using our free calculators today and take control of your money because even a small difference in interest calculation can lead to big changes in your financial future.

Frequently Asked Questions

Which is better – simple interest or compound interest?

Compound interest is generally better for investments as it allows your money to grow faster. Simple interest is better when you are borrowing, as you pay less overall.

How does compound interest grow wealth?

Because interest is calculated on both the principal and previously earned interest, your balance grows exponentially over time.

Can I convert simple interest into compound interest?

Not directly, but you can invest money earned from simple interest into accounts that compound interest.

Is compound interest always good?

Not necessarily. For borrowers, compound interest can make debt more expensive, especially with frequent compounding (like on credit cards).