Understanding Amortization: A Beginner’s Guide

Managing loans and repayments can be confusing when you’re new to personal...

Debt is not necessarily a bad thing. When used wisely, loans can help you achieve life goals like buying a home, funding education, or growing a business. However, the danger comes when borrowing turns into overborrowing taking on more debt than you can comfortably repay.

According to a recent report by the Federal Reserve, about 37% of Americans struggle with unexpected expenses because their debt payments eat into savings and emergency funds. This is where smart borrowing tips and tools like a loan calculator come in handy.

As personal finance expert Suze Orman once said:

“Borrowing isn’t the problem borrowing more than you can handle is.”

Overborrowing happens when a person takes out a loan amount that exceeds their repayment capacity. Common reasons include:

Loan calculators help you avoid financial blind spots by providing realistic numbers before committing to a loan.

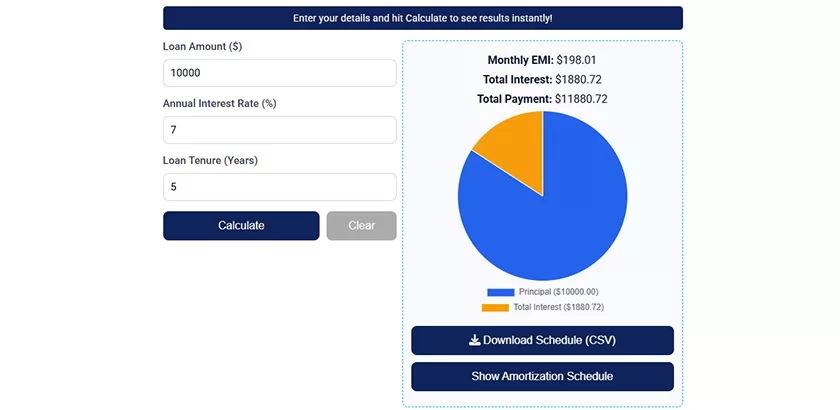

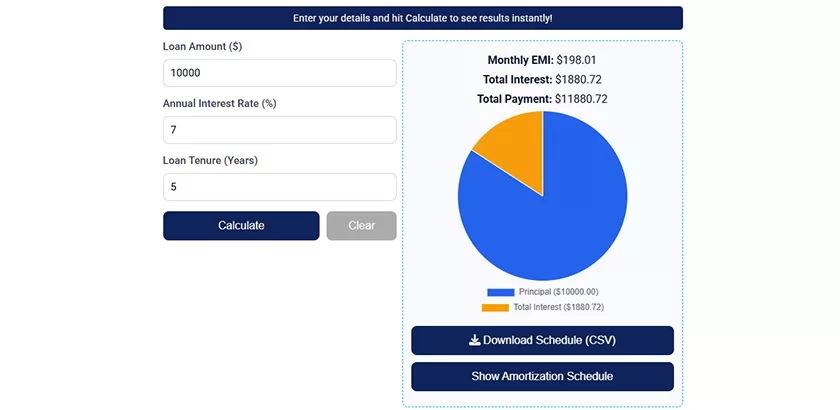

A loan calculator breaks down your monthly payments based on loan amount, term, and interest rate. This way, you know exactly what you’ll owe every month.

Borrowing $20,000 at 10% interest over 5 years isn’t just $20,000 it could end up being $25,000+ with interest. A calculator shows the full picture.

You can adjust loan amounts, shorten the repayment period, or try lower interest rates to see how it impacts your payments.

By testing multiple amounts, you’ll realize that sometimes borrowing a little less can make a big difference in repayment comfort.

Here are practical smart borrowing tips that every borrower should follow:

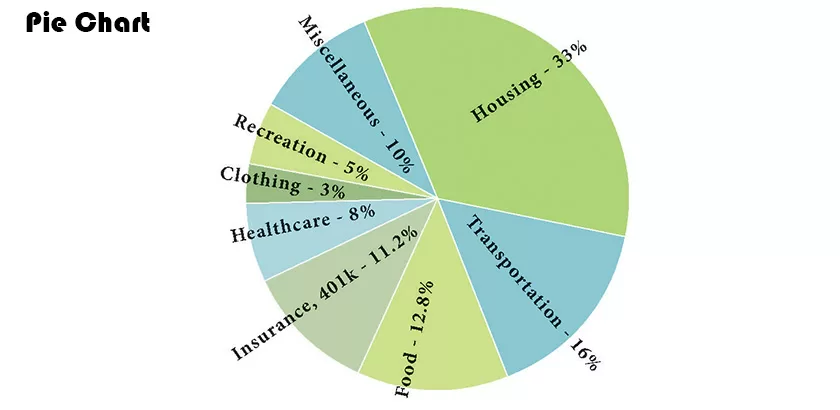

Financial planners recommend that:

By plugging numbers into a loan calculator, you can instantly check if your loan keeps you within safe limits.

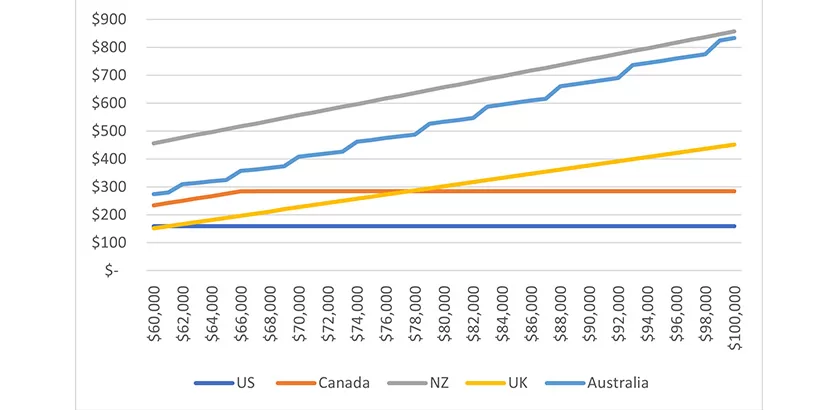

Don’t accept the first loan deal. Compare interest rates, terms, and hidden fees. A small difference in interest (say 9% vs. 11%) can save thousands over time.

“The difference between a good loan and a bad loan is often hidden in the details.” Dave Ramsey

Most calculators let you add extra payments. Even paying an extra $100 a month can cut years off your loan term.

Life is unpredictable. Before borrowing, make sure you can still manage payments if you face job loss, medical expenses, or inflation.

Loans should be a tool for progress, not for lifestyle inflation. Borrowing to buy the latest phone, luxury car, or unnecessary gadgets leads to financial strain.

Loan Calculator Monthly EMI And Total Interest – Free & Easy Tool

Using a loan calculator isn’t just about crunching numbers it’s about making informed choices. By applying these smart borrowing tips, you protect your financial health, avoid debt traps, and stay on track with your goals.

As financial author Robert Kiyosaki puts it:

“It’s not how much money you make, but how much money you keep and how little debt you carry that determines wealth.”

So next time you’re about to borrow, spend five minutes with a calculator. It could save you years of stress and thousands of dollars.

Yes, if you enter the correct loan terms, it gives you a close estimate. However, fees and penalties may vary depending on the lender.

Not always. Longer terms reduce monthly payments but increase total interest. A calculator helps balance both.

Yes! Even small extra payments reduce total interest and shorten the loan term.

Yes, most financial websites including ours offer free calculators for personal use.

Managing loans and repayments can be confusing when you’re new to personal...