Compound Interest Calculator Grow Your Savings

Enter your details and hit Calculate to see results instantly!

Compound Interest Calculator – Plan Smarter, Grow Faster

When it comes to building long-term wealth, compound interest is often called the “eighth wonder of the world.” Unlike simple interest, where you only earn returns on the original principal, compound interest allows your savings to grow exponentially because you earn interest on both your principal and accumulated interest over time. Our Compound Interest Calculator is designed to help you visualize this growth, calculate potential future balances, and plan your savings or investments more effectively.

What Is a Compound Interest Calculator?

A Compound Interest Calculator is a financial tool that estimates how much your money will grow when invested or saved at a certain interest rate, over a specific period, with a given compounding frequency. It helps you answer questions like:

- How much will my savings be worth in 10 years?

- What is the total interest I will earn on my investment?

- How does monthly compounding differ from annual compounding?

- How much do I need to invest today to reach my future financial goals?

By providing clear projections, this calculator eliminates the guesswork from financial planning and gives you confidence in your long-term strategy.

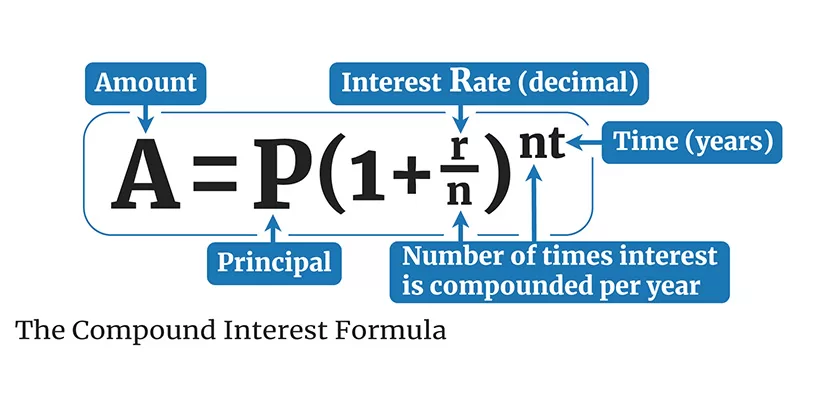

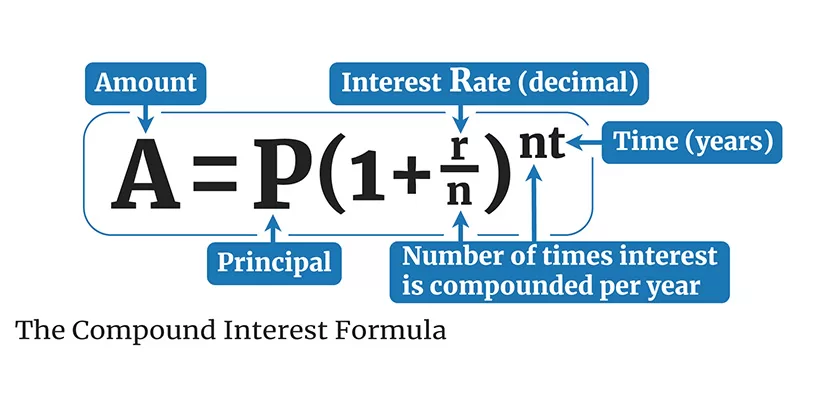

The Formula Behind Compound Interest

Our calculator uses the standard compound interest formula:

Where:

- A = Final Amount (Principal + Interest)

- P = Principal (initial investment)

- r = Annual Interest Rate (decimal form, e.g., 8% = 0.08)

- n = Number of compounding periods per year (monthly = 12, quarterly = 4, annually = 1)

- t = Time in years

This formula demonstrates the power of compounding: the more frequent the compounding, the faster your savings grow.

Example of Compound Interest in Action

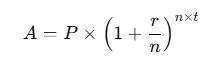

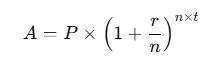

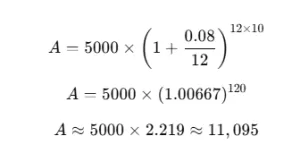

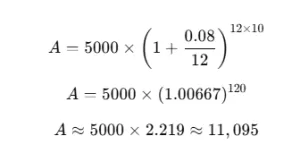

Let’s say you invest $5,000 at an annual interest rate of 8%, compounded monthly (n = 12), for 10 years.

Using the formula:

So, your investment would grow to approximately $11,095, with $6,095 earned in interest alone.

This example highlights how powerful compound interest can be over time — your money more than doubled in 10 years without additional contributions.

Key Features of Our Compound Interest Calculator

- Final Balance – See exactly how much your investment will grow.

- Total Interest Earned – Understand how much of your final amount comes from compounding.

- Pie Chart Visualization – Clear breakdown of principal vs. interest earnings.

- Amortization Schedule Toggle – Year-by-year breakdown of your balance growth.

- CSV Download Option – Save the full schedule for record-keeping or financial planning.

- Auto-Calculation with Default Values – Instantly see how compound interest works when the page

Why Use This Compound Interest Calculator?

- Clarity: Instantly visualize the difference between principal and earnings.

- Accuracy: Based on the universal compound interest formula.

- Flexibility: Adjust years, rates, and compounding frequency to fit your scenario.

- Planning: Ideal for savings, investments, retirement planning, or education funds.

How This Tool Helps in Real Life

- Savings Planning: Know how much your emergency fund will grow in 5, 10, or 20 years.

- Investment Forecasting: Compare different interest rates and compounding periods.

- Retirement Planning: Estimate future nest egg size with long-term compounding.

- Education Funds: Plan how much you need to set aside for future education expenses.

Conclusion

Our Compound Interest Calculator isn’t just about numbers; it’s about financial empowerment. By understanding how compounding works, you can make smarter decisions today that lead to greater financial freedom tomorrow. Whether you’re saving for retirement, investing in stocks, or just curious about your money’s growth potential, this calculator gives you the insights you need to plan confidently.

Take control of your finances today try the calculator, experiment with values, and watch how compounding can turn small savings into significant wealth over time.

Frequently Asked Questions

What is a Compound Interest Calculator?

A Compound Interest Calculator is a tool that helps estimate how much your savings or investment will grow over time by applying compound interest. It shows the final balance, total interest earned, and a detailed breakdown based on your inputs.

How accurate is this Compound Interest Calculator?

This calculator uses the standard compound interest formula, making results highly accurate. Actual earnings may vary slightly due to factors like taxes, fees, or market fluctuations if applied to investments.

Can I use the Compound Interest Calculator for retirement planning?

Yes. The Compound Interest Calculator is ideal for retirement planning because it shows how your savings will grow over long periods. By adjusting years, rates, and compounding frequency, you can forecast your retirement nest egg more precisely.