Credit Card Payoff Calculator – Achieve Debt Freedom Faster

Enter your details and hit Calculate to see results instantly!

Credit Card Payoff Calculator – Calculate Your Debt-Free Timeline

Are you feeling weighed down by credit card debt that never seems to shrink? You’re not alone. Millions of people struggle with high-interest balances that grow faster than they can pay them off. That’s where our free Credit Card Payoff Calculator comes in it’s designed to give you clarity, control, and a clear path to becoming debt-free.

Whether you’re making minimum payments or planning a more aggressive repayment strategy, this tool helps you visualize your journey toward financial freedom. It shows how long it will take to eliminate your debt, how much interest you’ll pay over time, and how adjusting your monthly payments can accelerate your progress.

What is a Credit Card Payoff Calculator?

A Credit Card Payoff Calculator is a financial planning tool that helps you understand the timeline and cost of repaying your credit card debt. By entering key details such as your current balance, annual percentage rate (APR), and monthly payment amount—you’ll receive a personalized estimate of:

- Total interest paid over the life of the debt

- Total repayment amount (principal + interest)

- Estimated payoff time in months or years

- Month-by-month breakdown in an amortization schedule

This tool replaces guesswork with precision, giving you a visual roadmap to becoming debt-free.

How Does It Work?

The calculator uses a standard loan amortization formula to break down each monthly payment into two parts:

- Interest: Calculated based on your current balance and APR

- Principal: The portion of your payment that reduces the actual debt

Each month, your payment chips away at the balance while interest is recalculated based on the remaining amount. This cycle continues until your balance reaches zero.

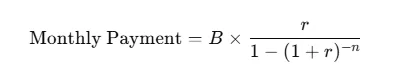

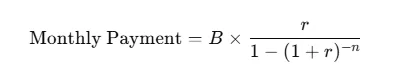

The Formula

Let’s break it down:

- B = Balance (loan amount)

- r = Monthly interest rate (APR ÷ 12)

- n = Total number of payments

This formula ensures that every payment is calculated accurately, showing exactly how much goes toward interest and how much reduces your debt.

Example: See It in Action

Imagine you have:

- Balance: $5,000

- APR: 18% (0.18 annual, 0.015 monthly)

- Monthly Payment: $200

Month 1

- Interest = $5,000 × 0.015 = $75

- Principal = $200 – $75 = $125

- New Balance = $4,875

Month 2

- Interest = $4,875 × 0.015 = $73.13

- Principal = $200 – $73.13 = $126.87

- New Balance = $4,748.13

Continuing this pattern, your debt would be paid off in approximately 32 months, with a total interest cost of $1,379. That means your total repayment would be $6,379.

Now imagine increasing your monthly payment to $250. You’d pay off the debt faster and save hundreds in interest. This is the kind of insight our calculator provides instantly.

Why Use a Credit Card Payoff Calculator?

Understanding your debt is the first step toward eliminating it. This calculator helps you:

- See the true cost of carrying credit card debt

- Plan repayment strategies by adjusting payment amounts

- Save money on interest by exploring faster payoff options

- Stay motivated with a clear debt-free date

- Avoid falling into long-term debt traps

It’s not just about numbers—it’s about empowering you to take control of your financial future.

Key Features That Make It Valuable

Here’s what sets our calculator apart:

- Transparency: Clearly shows how each payment affects your balance

- Motivation: Seeing your debt-free date keeps you focused

- Flexibility: Test different payment scenarios to find the best strategy

- Visualization: Pie charts and amortization schedules make repayment easier to understand

- Record-Keeping: Downloadable CSV files let you track your progress over time

Whether you’re managing a single card or juggling multiple balances, this tool adapts to your needs.

Tips to Pay Off Credit Card Debt Faster

Using the calculator is a great start—but pairing it with smart strategies can supercharge your results:

- Pay more than the minimum: Even an extra $20 per month can shave months off your timeline

- Avalanche method: Focus on the highest-interest card first to save the most money

- Snowball method: Pay off the smallest balance first for a quick win and motivation boost

- Automate payments: Set up auto-pay to avoid missed due dates and late fees

- Balance transfers: Move high-interest debt to a 0% APR card if you qualify

These tactics, combined with insights from the calculator, can help you become debt-free faster than you thought possible.

Explore More Financial Calculators

Paying off credit cards is only one step toward financial freedom. Explore our other free tools:

- Loan Calculator – Estimate EMI payments

- Savings Goal Calculator – Plan smarter savings

- Investment Calculator – Grow wealth with smart planning

- Retirement Calculator – Secure your financial future

Each tool is designed to give you clarity, confidence, and control over your money.

Final Insight

Our Credit Card Payoff Calculator is more than just a digital tool it’s your personal financial coach. It helps you understand the true cost of your debt, explore repayment strategies, and stay motivated with a clear timeline to freedom.

By showing you exactly how long it will take to eliminate your credit card balances and how much interest you’ll pay, it empowers you to make smarter, more informed financial decisions. Whether you’re tackling one card or several, this calculator gives you the insight you need to take action.

Start using it today and take the first step toward a debt-free life one payment at a time.

Frequently Asked Questions

Does the calculator include fees or late charges?

No, it calculates based on balance, APR, and payments. You should add fees separately.

What if I only pay the minimum payment?

The calculator will show that it takes much longer to pay off your debt and interest costs increase dramatically.

Can I use this calculator for multiple credit cards?

Yes, but you’ll need to calculate each card separately or combine balances.

How can I pay off debt faster?

Increase your monthly payment or make extra payments whenever possible.

Is this tool suitable for balance transfers?

Yes, you can adjust APR to reflect promotional rates.