The Ultimate Debt to Income Ratio – Master Your Money

Enter your details and hit Calculate to see results instantly!

Debt to Income Ratio Calculator: Measure Your Financial Health

A Debt to Income Ratio Calculator is a simple yet powerful tool that helps you evaluate your financial stability by comparing your monthly debt payments to your gross monthly income. Lenders rely heavily on your Debt to Income Ratio (DTI) when deciding whether to approve you for a loan, mortgage, or credit card.

A lower Debt to Income Ratio means you have more financial flexibility and a higher chance of loan approval.

How Does the Debt to Income Ratio Work

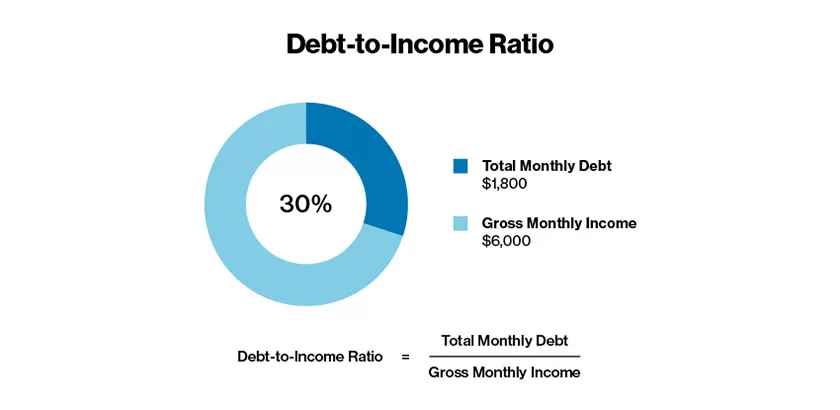

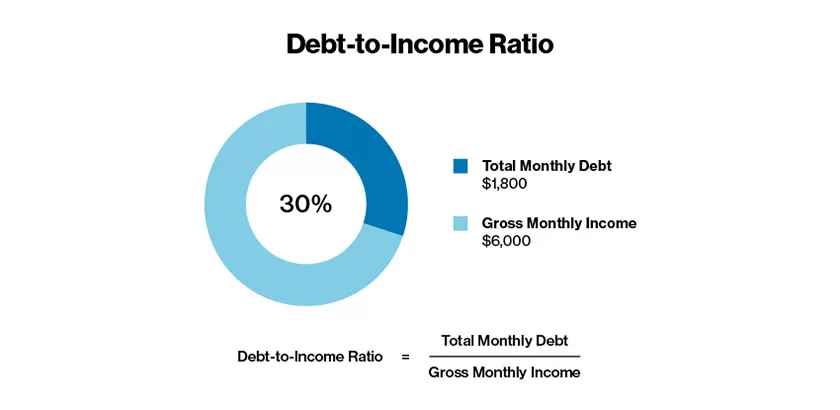

The Debt to Income Ratio is calculated using this formula:

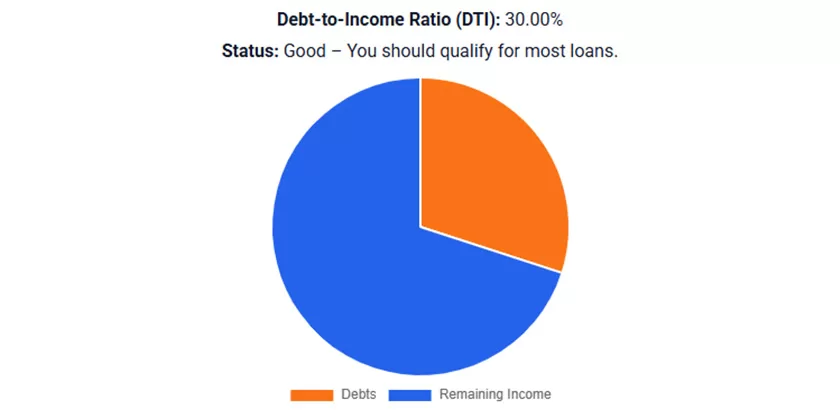

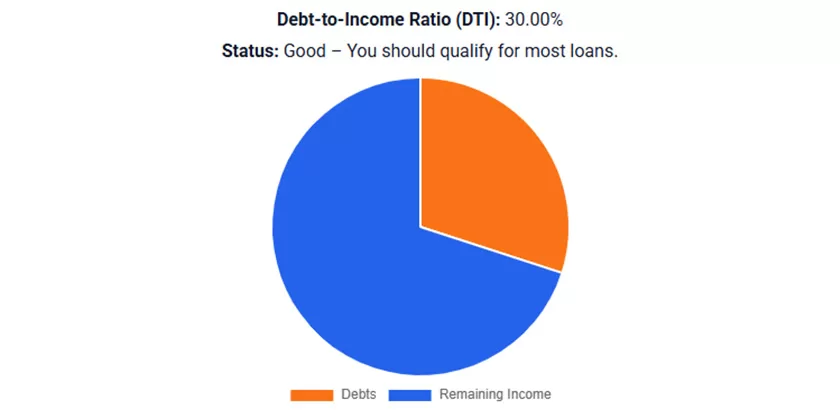

DTI = (Total Monthly Debt ÷ Gross Monthly Income) × 100

For example:

- Monthly Income: $5,000

- Monthly Debt Payments: $1,500

DTI = (1,500 ÷ 5,000) × 100 = 30%

This percentage shows lenders how much of your income goes toward debt versus how much is left for housing, savings, and living expenses.

Why Your Debt to Income Ratio Matters for Loan

Banks, mortgage companies, and credit card issuers want to ensure you’re not financially overextended.

- Low DTI = Safer borrower, higher approval chances

- High DTI = Riskier borrower, harder to qualify

Most lenders prefer a Debt to Income Ratio below 36%, with no more than 28% going toward housing expenses.

Example: Debt to Income Ratio Calculation

Imagine you have these monthly debts:

- Mortgage: $1,200

- Auto Loan: $300

- Credit Card Payments: $200

- Student Loan: $400

Total Debts = $2,100

Gross Monthly Income = $6,000

DTI = (2,100 ÷ 6,000) × 100 = 35%

This falls within the acceptable range, but lowering it further could help you secure better loan terms.

Ideal Debt to Income Ratio Ranges

- Below 20%: Excellent – Very safe, high approval chances

- 20–36%: Good – Eligible for most loans

- 37–43%: Acceptable – May still qualify, but lenders are cautious

- Above 43%: High risk – Loan approval unlikely without improving finances

How to Improve Your Debt to Income Ratio

If your Debt to Income Ratio is too high, here are proven strategies to lower it:

- Pay down high-interest debts (credit cards first)

- Increase your income through side jobs or freelancing

- Avoid taking on new loans until your DTI improves

- Refinance existing loans for lower monthly payments

- Budget smarter and allocate extra funds toward debt repayment

Even small steps, like paying an extra $100 toward credit cards each month, can significantly reduce your DTI over time.

Benefits of Using Our Free Debt to Income Ratio Calculator

- Quick & accurate DTI calculation

- Visual breakdown of debts vs. income (pie chart)

- Clear status interpretation (Excellent, Good, Fair, Risky)

- Downloadable results for record-keeping (CSV format)

- Helps you prepare for mortgage or loan applications

- 100% free to use, no registration required

Final Insight

Your Debt to Income Ratio is more than just a number—it’s a reflection of your overall financial health. By understanding and improving your DTI, you can:

- Increase your chances of loan approval

- Unlock better interest rates

- Reduce financial stress

Start using our free Debt to Income Ratio Calculator today and take the first step toward financial freedom.

Explore More Financial Calculators

Improving your Debt to Income Ratio is just one part of financial wellness. Explore our other free tools:

Frequently Asked Questions

What is a Debt-to-Income (DTI) ratio?

A Debt-to-Income ratio is the percentage of your gross monthly income that goes toward paying debts such as credit cards, auto loans, student loans, and mortgages.

Why is my DTI important for loan approval?

Lenders use DTI to assess your ability to handle new debt. A lower DTI shows financial stability, making you more likely to qualify for mortgages, personal loans, and credit cards.

What is a good DTI ratio?

A good DTI ratio is generally 36% or less. Ratios under 20% are considered excellent, while anything above 43% may make it difficult to get approved for loans.

How do I calculate my DTI manually?

Add up all your monthly debt payments (loans, credit cards, mortgages) and divide the total by your gross monthly income. Multiply by 100 to get the percentage.

How can I lower my DTI ratio?

You can lower your DTI by paying off high-interest debts, refinancing loans, avoiding new debt, or increasing your income through side hustles or career growth.