Investment Calculator Maximize Your Future Wealth

Enter your details and hit Calculate to see results instantly!

Investment Calculator Smart Tool to Grow Your Wealth

Investing is one of the most powerful ways to build wealth and achieve financial independence. Whether you are saving for retirement, your child’s education, or simply looking to grow your money, understanding how your investments will perform is crucial. Our Investment Calculator helps you estimate the future value of your investments, project returns, and visualize how your contributions and compounding work together over time.

What is an Investment Calculator?

An Investment Calculator is a financial planning tool that allows you to project the growth of your investments over time. By entering your initial investment amount, regular contributions, expected annual return, and time horizon, the calculator shows you:

- The total future value of your investment.

- The total contributions you’ve made.

- The growth generated by compounding interest.

- A year-by-year investment growth schedule.

This calculator makes complex financial math simple, giving you an easy way to plan, compare scenarios, and set realistic financial goals.

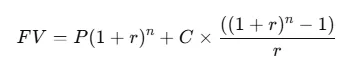

The Formula Behind the Investment Calculator

Our calculator uses the Future Value (FV) of an initial investment plus regular contributions formula:

Where:

- FV = Future Value of your investment

- P = Initial Investment (starting balance)

- C = Regular Contribution (monthly or yearly)

- r = Periodic Interest Rate (annual rate ÷ number of periods)

- n = Total number of periods

This formula combines the growth of your initial investment with the growth of your recurring contributions.

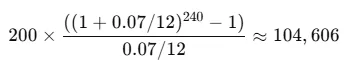

Example: How the Investment Calculator Works

Let’s take an example of James, a young investor:

- Initial Investment (P): $10,000

- Monthly Contribution (C): $200

- Annual Return Rate: 7% (0.07)

- Years: 20

Future Value of Initial Investment:

10,000×(1+0.07/12)240≈40,387

Future Value of Contributions:

Total Future Value (FV):

40,387+104,606=144,993

James will contribute a total of $58,000 ($200 × 240 periods + $10,000 initial), but thanks to compounding, his wealth grows to $144,993 earning over $86,000 in growth.

Purpose of the Investment Calculator

The main purpose of this tool is to:

- Estimate your investment growth over time.

- Show the power of compound interest in building wealth.

- Help you decide contribution amounts to reach your financial goals.

- Compare scenarios (monthly vs yearly contributions, different return rates).

- Visualize results with charts and schedules.

Why This Calculator is Valuable for Users

- Clarity & Confidence: Helps users plan investments without complex spreadsheets.

- Flexibility: Supports both monthly and yearly contributions.

- Visual Insights: Pie chart for contributions vs. growth.

- Detailed Tracking: Amortization style growth schedule.

- Record-Keeping: Downloadable CSV file for long-term financial planning.

Benefits of Using the Investment Calculator

- Encourages disciplined saving and investing.

- Shows how small contributions grow massively over time.

- Makes it easy to set and adjust financial goals.

- Ideal for students, professionals, and retirees.

- Completely free and available online anytime.

Our Investment Calculator isn’t just about numbers it’s a roadmap to financial freedom. By clearly separating your contributions from growth, it empowers you to understand how investing works, how compounding accelerates wealth, and how small consistent contributions can lead to big results.

Explore More Financial Calculators

Investing is only one part of financial planning. To make smarter decisions, explore our other calculators: the Retirement Calculator to plan for future wealth, the Savings Goal Calculator to reach milestones faster, the Loan Calculator to manage debt, and the Compound Interest Calculator to understand the magic of compounding. Together, these tools give you a 360° view of your financial journey.

Frequently Asked Questions

Can the Investment Calculator predict exact returns?

No, it provides projections based on the values you input. Actual returns depend on market performance.

What return rate should I use?

A conservative return rate of 5–7% annually is often recommended for long-term investments.

Can I calculate with irregular contributions?

This version assumes consistent contributions, but you can adjust values to reflect an average.

Is this tool suitable for retirement planning?

Yes, it works great as a retirement planning tool when paired with our Retirement Calculator.

Can I download my results?

Yes, the calculator provides a downloadable CSV growth schedule for record-keeping.