Loan Calculator Monthly EMI And Total Interest – Free & Easy Tool

Enter your details and hit Calculate to see results instantly!

Loan Calculator Monthly EMI and Total Interest – Plan Smarter, Borrow Better

Taking out a loan doesn’t have to feel like stepping into the unknown. Whether it’s for a car, education, or a personal expense, knowing exactly what you’ll pay each month—and how much interest you’ll pay over time can make all the difference. That’s where our Loan Calculator Monthly EMI and Total Interest comes in.

This powerful tool gives you instant clarity on your loan obligations, helping you make confident financial decisions without the stress of manual calculations or spreadsheet guesswork.

What Is a Loan Calculator?

A Loan Calculator Monthly EMI and Total Interest is an easy-to-use online tool that helps you calculate:

- Your monthly EMI (Equated Monthly Installment)

- The total interest you’ll pay over the life of the loan

- The total repayment amount (principal + interest)

Just enter three simple inputs:

- Loan amount

- Annual interest rate

- Loan tenure (in years)

With these, the calculator instantly shows you how much you’ll owe each month and how much the loan will cost you in total. No more guesswork. No more surprises.

How Our EMI Calculator Works

Our calculator uses the standard EMI formula:

EMI = [P × r × (1 + r)^n] / [(1 + r)^n – 1]

Where:

- P = Principal loan amount

- r = Monthly interest rate (Annual ÷ 12 ÷ 100)

- n = Total number of monthly installments

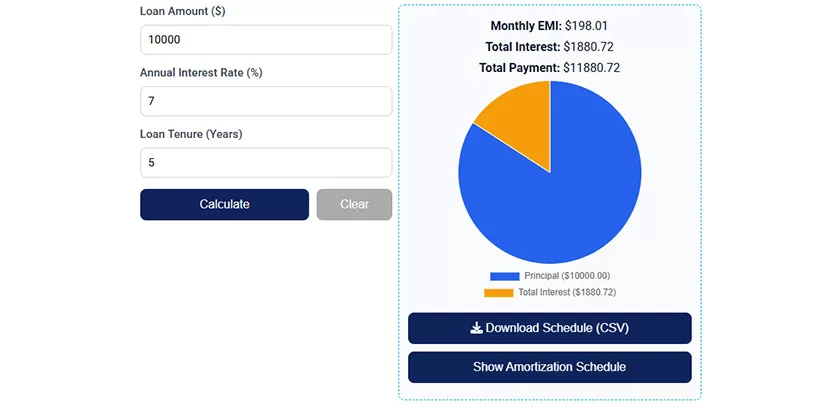

Once you hit “Calculate,” you’ll instantly see:

- Monthly EMI – Your fixed monthly payment

- Total Interest – The full interest cost over the loan term

- Total Payment – The sum of principal and interest

Amortization Schedule: Your Loan, Month by Month

One of the most valuable features of our Loan Calculator Monthly EMI and Total Interest is the Amortization Schedule. This detailed table shows:

- How much of each EMI goes toward interest

- How much reduces your principal

- Your remaining loan balance after each payment

This breakdown helps you understand how your loan evolves over time. It’s especially useful if you’re planning to make prepayments or close your loan early. You can even download the schedule as a CSV file to analyze in Excel or Google Sheets.

Why Use This Loan Calculator?

Here’s why thousands of users rely on our Loan Calculator Monthly EMI and Total Interest:

- Instant Results – No manual math or spreadsheets

- Accurate EMI Calculation – Based on standard formulas

- Detailed Amortization – Month-by-month breakdown

- Downloadable CSV – Keep records or share with advisors

- Visual Insights – Pie chart for easy loan comparison

Whether you’re comparing loan offers or planning your budget, this tool helps you make smarter, faster decisions.

Works for All Types of Loans

Our calculator isn’t limited to one type of credit. It works seamlessly for:

- Personal loans

- Car loans

- Education loans

- Home improvement loans

- Any installment-based credit

No matter your borrowing need, you’ll get accurate figures every time.

Make Smarter Financial Decisions

Understanding your Loan Calculator Monthly EMI and Total Interest helps you:

- Choose the most affordable loan option

- Avoid overborrowing and financial strain

- Plan your budget with confidence

- Explore prepayment strategies to save on interest

- Compare multiple loan offers side by side

Even a small change in loan tenure or interest rate can impact your total cost significantly. Our calculator helps you see those changes instantly.

Final Insight: Take Control of Your Loan Journey

The burden of a loan becomes lighter when you’re fully informed. With our Loan Calculator Monthly EMI and Total Interest, you gain the clarity you need to borrow wisely and repay confidently. Whether you’re planning a new loan or evaluating an existing one, this tool puts you in control of your financial future.

Try it today and discover how simple, smart, and stress-free loan planning can be.

Frequently Asked Questions

What is a Loan Calculator Monthly EMI and Total Interest?

It’s an online tool that helps you calculate your monthly loan payments (EMI), total interest payable, and total repayment amount based on your loan amount, interest rate, and tenure.

How does the EMI calculation work?

The calculator uses a standard formula that factors in your principal amount, monthly interest rate, and total number of installments to compute your fixed monthly payment.

What details do I need to use the calculator?

You’ll need to enter your loan amount, annual interest rate, and loan tenure in years. Optional fields like processing fees or prepayments can help refine your results.

Can I use this calculator for different types of loans?

Yes, it works for personal loans, car loans, education loans, home improvement loans, and any installment-based credit.

What is an amortization schedule?

An amortization schedule is a table that shows how each EMI is split between interest and principal, along with the remaining balance after each payment.

How accurate are the results?

The calculator provides close estimates based on standard formulas. Actual figures may vary slightly depending on lender-specific fees and terms