Personal Loan Calculator to Empower Your Finances

Enter your details and hit Calculate to see results instantly!

Personal Loan Calculator – Plan Your Borrowing with Confidence

Borrowing money can feel like stepping into the unknown. Whether it’s funding a wedding, consolidating debt, covering medical bills, or financing a dream vacation, you deserve clarity on how much you’ll actually pay. Our Personal Loan Calculator takes the guesswork out of borrowing by providing instant insights into your monthly payments (EMI), total repayment, and overall interest charges no complex formulas required.

With just three inputs, you’ll see detailed results in seconds. Armed with this information, you can compare loan offers, adjust amounts or terms, and make borrowing decisions that fit your budget and financial goals.

Why You Need a Personal Loan Calculator

- Eliminate Surprises A personal loan isn’t just the amount borrowed it’s the interest, fees, and repayment term all wrapped together. Our calculator helps you understand the true cost up front.

- Budget with Precision Knowing your exact EMI lets you plan monthly expenses, avoid overextending your finances, and maintain healthy cash flow.

- Compare Lender Offers Enter different interest rates or loan terms to instantly see which offer gives you the lowest monthly payments and total cost.

- Empower Smart Borrowing When you have clear numbers in hand, you negotiate with confidence and choose the loan that aligns with your financial priorities.

How Our Personal Loan Calculator Works

Our Personal Loan Calculator is designed for simplicity and accuracy:

Inputs

- Loan Amount: The principal you wish to borrow.

- Annual Interest Rate (%): The lender’s annual percentage rate.

- Loan Term (Years or Months): Your repayment period.

Instant Outputs

- Monthly Payment (EMI): Your fixed monthly installment.

- Total Interest Paid: Cumulative interest over the life of the loan.

- Total Loan Repayment: Sum of principal plus interest.

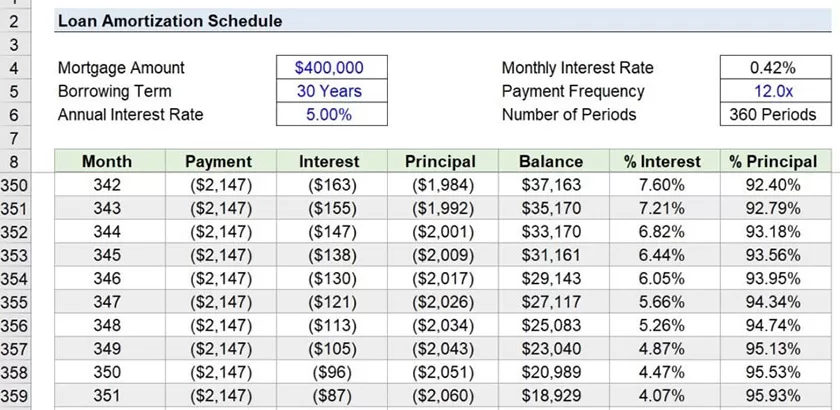

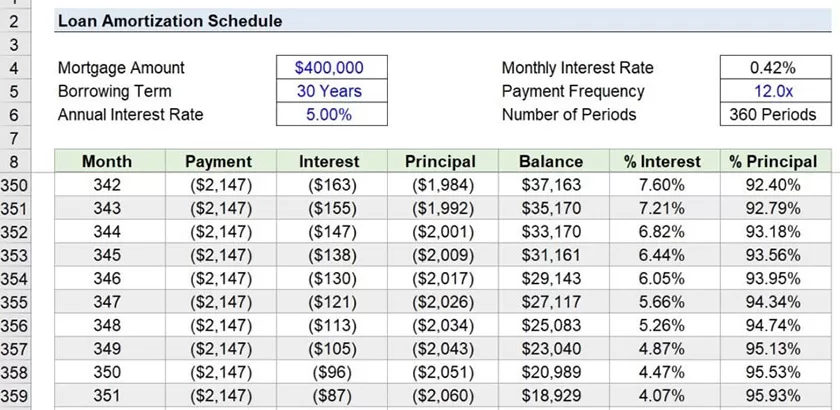

- Amortization Schedule: A month-by-month breakdown of principal vs. interest.

Our backend uses industry-standard amortization formulas, so you can trust the results are accurate and up to date.

Step-by-Step Guide

- Enter the Loan Amount you need.

- Fill in the Annual Interest Rate your lender offers.

- Select the Loan Term—either in years or months.

- Click “Calculate” and review your monthly EMI, total repayment, and interest cost.

- Download or print the amortization schedule for detailed planning and record-keeping.

Adjust any input to instantly see how a shorter term or lower rate affects your payments. This dynamic approach makes it easy to find the sweet spot between affordable EMIs and overall cost.

Who Should Use This Tool?

- Wedding Planners & Couples: Estimate loan costs for ceremonies, catering, and venues.

- Debt Consolidators: Compare refinancing offers to reduce total interest and monthly outflow.

- Medical Patients: Budget for healthcare expenses with transparent repayment figures.

- Travel Enthusiasts: Plan vacation loans without derailing your monthly budget.

- Small Business Owners: Forecast startup loans and manage cash flow.

- Financial Advisors: Provide clients with clear loan affordability checks.

- Students & Parents: Calculate education loan EMIs and repayment timelines.

Anyone contemplating a personal loan can benefit from accurate, instant insights.

Key Benefits of Our Personal Loan Calculator

- Quick & Reliable: Get precise EMI calculations in under five seconds.

- Clear Breakdown: See exactly how much goes toward interest versus principal every month.

- Flexible Scenarios: Experiment with multiple loan amounts, rates, and terms.

- Budget-Focused: Ensure your new loan payments fit seamlessly into your cash flow.

- Comprehensive Schedule: Download a full amortization table to track payments and plan ahead.

All features are 100% free—no sign-ups, no hidden fees, and zero ads interrupting your calculation.

Why Our Calculator Stands Out

- Mobile-Ready Design Use our tool on any device desktop, tablet, or smartphone. The responsive interface adapts to your screen size.

- Interactive Amortization Toggle Show or hide your detailed repayment schedule as needed, keeping your view uncluttered.

- CSV Download Export your amortization table for spreadsheets, record-keeping, or sharing with financial planners.

- Modern, Intuitive UI A clean design guides you through inputs and displays results with clarity, so you never feel overwhelmed.

Tips for Smarter Loan Planning

- Aim for a Shorter Term While longer terms lower monthly EMIs, they increase total interest. Test different durations to strike the right balance.

- Negotiate Rates Even a 0.5% reduction in interest can save thousands over the life of the loan. Use your calculator to quantify those savings.

- Account for Fees Some personal loans include origination or late-payment fees. Factor these into your budget even if they’re not included in the calculator.

- Prepayment Strategies Consider making extra payments when possible. Our amortization schedule shows how additional principal payments reduce interest and shorten loan duration.

Take Control of Your Loan Today

Stop wondering what your personal loan will truly cost calculate it. Our Personal Loan Calculator equips you with the exact EMI, total repayment, and interest breakdown you need to plan confidently. Whether you’re a borrower, advisor, or business owner, this free tool empowers you to make informed financial decisions.

Frequently Asked Questions

What is a Personal Loan Calculator?

A Personal Loan Calculator is a financial tool that helps you estimate your monthly EMI, total repayment amount, and total interest payable based on your loan amount, interest rate, and loan tenure.

How does the Personal Loan Calculator work?

It uses the standard loan amortization formula to calculate your Equated Monthly Installment (EMI). The formula considers principal (loan amount), annual interest rate, and repayment tenure to give accurate monthly payment estimates.

Can I use the calculator for different loan amounts?

Yes, you can adjust the loan amount, interest rate, and loan tenure to see how different values impact your EMI, interest, and repayment schedule.

Does the Personal Loan Calculator show an amortization schedule?

Yes, the calculator provides a detailed amortization schedule showing monthly payments, principal, interest, and remaining balance. You can also download the schedule in CSV format.

Is the Personal Loan Calculator free to use?

Absolutely. The calculator is free, easy to use, and designed to help you plan your loan repayment strategy without hidden costs.

How accurate is the Personal Loan Calculator?

The results are highly accurate based on the values you enter. However, final loan terms may vary depending on the lender’s policies and additional charges like processing fees.