Retirement Calculator Smart Planning for Your Future Wealth

Enter your details and hit Calculate to see results instantly!

Retirement Calculator Secure Your Future with Smart Financial Planning

Retirement planning is one of the most important financial decisions you will ever make. Whether you are just starting your career, mid-way through your professional journey, or close to retirement age, knowing how much you will need and how to reach that goal is crucial. Our Retirement Calculator is designed to give you a clear picture of your financial future by helping you calculate your expected savings, estimate growth from investments, and track your total contributions over time. With this tool, you can plan your retirement with confidence and make informed decisions about your savings strategy.

What is a Retirement Calculator?

A Retirement Calculator is a financial tool that estimates the future value of your retirement savings by taking into account factors like your current savings, annual contributions, expected rate of return, and the number of years until retirement. It uses the future value of compound interest formula to project how your investments will grow over time.

By entering a few simple details, you can see how much you’ll likely have saved by the time you retire, how much will come from your direct contributions, and how much will be generated through investment growth.

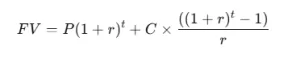

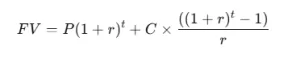

The Formula Behind the Retirement Calculator

Our calculator works on the future value of compound interest with regular contributions:

Where:

- FV = Future Value (your estimated retirement savings)

- P = Current Savings (your initial balance)

- r = Annual Rate of Return (expressed as a decimal)

- t = Number of Years until Retirement

- C = Annual Contribution

This formula accounts for both your existing savings growing through compounding and your regular yearly contributions growing as an annuity.

Example – How It Works

Let’s imagine Sarah, a 30-year-old professional, wants to retire at age 60. She currently has $20,000 in savings, contributes $6,000 annually, and expects an average return of 6% per year.

Using the Retirement Calculator:

Current Savings Future Value:

![]()

![]()

Future Value of Contributions:

![]()

![]()

Total Retirement Savings (FV):

115,736+503,006=618,742

By retirement, Sarah will have contributed a total of $200,000 (30 × $6,000 + $20,000 initial), but her investments will grow by over $418,742 thanks to compounding.

Purpose of the Retirement Calculator

The main purpose of the Retirement Calculator is to:

- Estimate Retirement Savings: See how much your current savings and contributions will grow over time.

- Plan Contributions: Adjust your annual contributions to meet your retirement target.

- Understand Investment Growth: Separate how much comes from your savings vs. market returns.

- Visualize Results: Use pie charts and amortization schedules to clearly understand your financial journey.

- Track and Adjust: Export results into CSV format for long-term planning and adjustments.

Why This Calculator is Valuable for Users

- Clarity & Transparency – Users can clearly see the breakdown of their contributions and investment growth.

- Visual Insights: Pie charts and schedules make complex numbers easy to understand.

- Customizable: Pre-filled example values help beginners, but inputs can be personalized.

- Record-Keeping: The option to download schedules into CSV helps users track progress year after year.

- Confidence in Planning: Provides reassurance that users are saving enough or guidance if they need to adjust their strategy.

Benefits of Using Our Retirement Calculator

- Helps you determine if you’re saving enough for retirement.

- Allows you to experiment with different contribution amounts and interest rates.

- Shows the power of compound interest over time.

- Encourages financial discipline and consistency.

- Makes retirement planning accessible for students, professionals, and business owners alike.

Key Takeaway

Our Retirement Calculator is more than just a financial tool it’s a roadmap to your financial freedom. By showing how your money grows with contributions and compounding, it empowers you to plan ahead, stay consistent, and achieve your dream retirement without stress.

Whether you’re aiming for a modest lifestyle or a luxurious retirement, this calculator helps you take control of your financial future today.

Explore More Financial Calculators

Planning for retirement is just one part of financial success. To make smarter money decisions, you can also explore our other free tools such as the Loan Calculator to estimate EMI payments, the Mortgage Calculator for home loan planning, the Savings Goal Calculator to reach your targets faster, and the Compound Interest Calculator to maximize your investment growth. Together, these calculators give you a complete picture of your financial future.

Frequently Asked Questions

How accurate is the Retirement Calculator?

The calculator gives accurate projections based on the inputs you provide, but actual results depend on market performance, inflation, and lifestyle changes.

What’s a safe rate of return to assume?

Many experts recommend using a conservative return of 5–7% annually for long-term planning.

Can I use this for early retirement planning?

Yes. Simply enter the number of years until your planned retirement age, even if it’s before the traditional retirement age.

How often should I update my calculations?

It’s recommended to revisit your retirement plan at least once a year or whenever your income, contributions, or investment goals change.

What if my contributions vary each year?

This calculator assumes consistent contributions, but you can adjust values anytime to reflect new savings amounts.