Smart Borrowing Tips with Loan Calculator

Introduction: Why Smart Borrowing Tips Matters Debt is not necessarily a bad...

Managing loans and repayments can be confusing when you’re new to personal finance. But one concept that every borrower should grasp is understanding amortization the foundation of how most loans work. Whether you’re paying off a mortgage, car loan, or student debt, learning how amortization functions can help you save thousands and plan your payments with confidence.

Understanding Amortization is the process of gradually paying off a loan over time through regular payments. Each payment covers two parts the principal (the original amount borrowed) and interest (the cost of borrowing).

In the beginning, most of your payment goes toward interest because the loan balance is high. Over time, as the principal decreases, a larger share of your payment goes toward actually reducing the debt.

“When you understand how amortization works, you stop seeing loans as numbers and start seeing them as a path toward freedom,” says financial coach Linda Monroe.

Understanding amortization empowers borrowers to take control of their financial future. Here’s why it’s important:

A small increase in awareness can make a big difference. For instance, paying just one extra payment per year can shave years off your loan term all because you understand how amortization works.

Let’s simplify it.

When you borrow money, your lender uses an amortization formula to calculate your monthly payment based on:

Each monthly payment is divided into interest and principal portions. Over time, interest decreases because it’s calculated on a smaller remaining balance.

If you take a $20,000 loan at 6% interest for 4 years:

This means you’ll pay slightly less interest every month as your principal reduces.

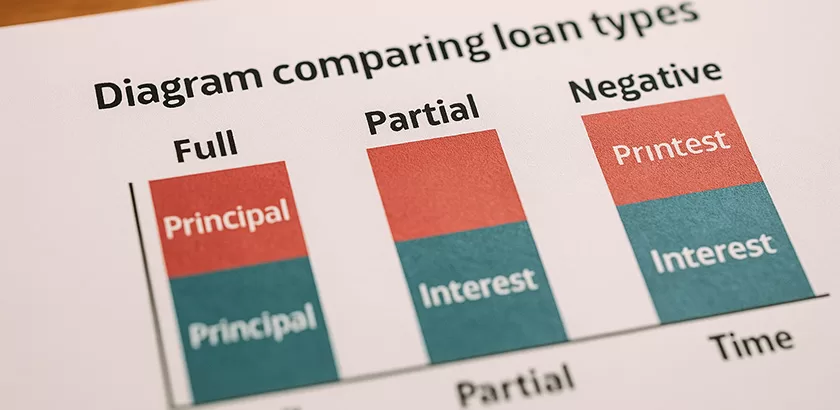

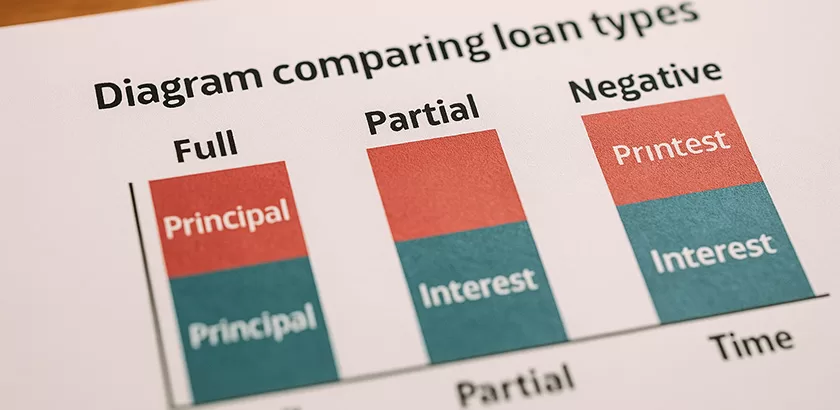

Different loans follow different amortization patterns. Here are the main types you’ll come across:

You pay off both principal and interest through regular, equal payments until the loan is completely repaid.

Example: Mortgages, car loans, and student loans.

You make regular payments for a set time, but a lump sum (called a balloon payment) remains at the end of the term.

Example: Some short-term commercial loans.

This happens when your monthly payment isn’t enough to cover the interest due. As a result, your loan balance increases over time instead of shrinking.

Example: Certain adjustable-rate mortgages.

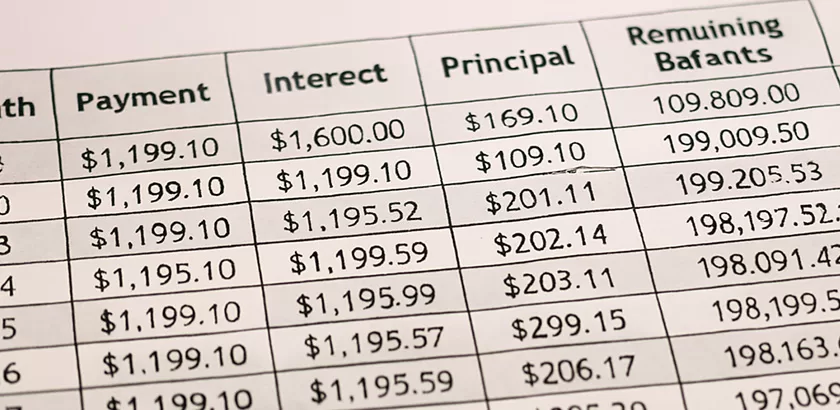

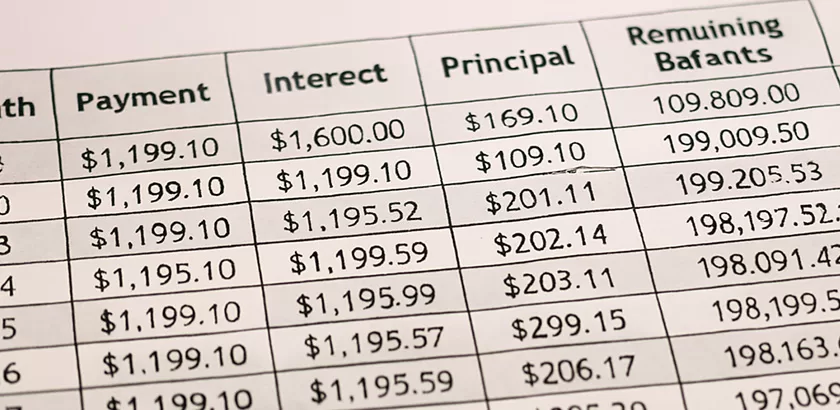

An amortization schedule is a detailed table showing every payment from start to finish. It lists:

By reviewing your schedule, you can see how your debt decreases each month. It’s a visual reminder that your payments are making progress, even if it feels slow at first.

You don’t need to manually calculate anything online tools make it simple.

Just enter:

You’ll get a complete amortization schedule, showing how much you pay each month and how fast your loan balance drops.

💡 Pro Tip: Experiment with shorter terms or extra payments to see how much interest you can save you might be surprised!

Once you understand how your payments are structured, it’s easier to plan your monthly budget and long-term goals. You’ll know how much money to allocate toward debt, savings, and investments.

Seeing your principal balance fall over time is motivating. When you notice how even small extra payments reduce total interest, you’ll stay consistent with your financial plan.

You can use amortization knowledge to compare different loan offers. A 5-year loan with a lower interest rate might save you more than a 7-year loan with smaller payments.

Paying off principal faster reduces the interest charged on future payments a key strategy for debt freedom.

Even with calculators and loan tools, many borrowers misunderstand amortization. Here are frequent mistakes to avoid:

“Understanding amortization is like reading the fine print of your financial future it tells you the truth about what borrowing really costs.” Sarah Lopez, Financial Educator

Avoid late fees by automating your monthly loan payments.

Splitting your payment in half and paying every two weeks means one extra payment a year reducing interest naturally.

If interest rates fall, refinancing can shorten your loan term and reduce costs.

Regularly reviewing your amortization schedule keeps you accountable and motivated to stay debt-free.

Amortized loans differ from simple interest loans. In simple interest loans, interest is calculated only on the remaining principal each month. In amortized loans, each payment includes both interest and principal, leading to a steady decline in balance.

Understanding amortization isn’t just about numbers it’s about empowerment. When you know how your payments are structured, you can make informed borrowing choices, save money, and reach debt freedom faster.

Before signing any loan, take a few minutes to explore how Understanding amortization affects your total cost. Tools like the FinzCalc Loan Amortization Calculator give you instant clarity turning complex finance into smart, stress-free planning.

“Financial freedom begins with financial understanding. Learn it, use it, and watch your debt shrink faster than you thought possible.”

Loan amortization refers to the process of gradually repaying a loan through regular payments over time. Each payment covers both principal and interest, helping you build equity as you pay down your debt.

With amortization, you repay both principal and interest in each payment. In contrast, an interest-only loan requires paying just the interest for a set period, delaying repayment of the principal amount.

Understanding amortization helps you plan better, avoid overborrowing, and calculate total interest costs. It empowers borrowers to compare loans effectively and manage long-term financial commitments wisely.

You can use an Amortization Calculator available on FinzCalc to see how your payments are distributed between principal and interest, and to create a full loan repayment schedule instantly.

Yes. Extra payments directly reduce the principal balance, shortening the loan term and lowering total interest costs a smart way to save money over time.

Introduction: Why Smart Borrowing Tips Matters Debt is not necessarily a bad...